Telangana’s SGS maturity profile to last 20 years: RBI report | Hyderabad News

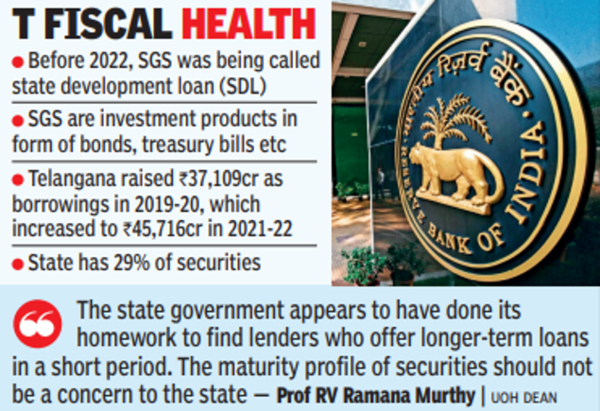

SGS was earlier state development loan (SDL), which was changed to SGS at a meeting of state finance secretaries in July 2022. Finance experts explained that securities are investment products issued by both central and state governments in the form of bonds, treasury bills or notes.

The RBI, in its latest report on ‘State Finances 2022-23’, said states like Tamil Nadu (10%), Punjab (3%), Rajasthan (2%), Kerala (2%) and MP and West Bengal (below 1%) have longer maturity profiles of securities which are set to last beyond 20 years.

Financial experts said that going by the RBI’s report, the findings can be both handy and detrimental to Telangana’s securities maturity profile. Professor RV Ramana Murthy, dean of University of Hyderabad, said Telangana government was smart enough to postpone the repayment of loans for longer periods of time. “The state government appears to have to done its homework to find lenders who offer longer-term loans in a short period. The maturity profile of securities should not be a concern to the state,” he told TOI.

He said because of the Centre’s policies, southern states were forced to borrow more. “There was a sudden change in the CGST distribution of the central pool as population of 2011 was taken into account instead of 1972. In the mean time, southern states’ population growth has stopped while other states’ population growth kept climbing at a higher rate. Though 40 per cent of CGST gets distributed to states, population is one of the criterion,” he pointed out.

Senior finance expert K Narasimha Murthy, however, has a word of caution. “Long-term maturity may indicate a burden lifted from the government, but it will be passed on to the people. Telangana was able to obtain loans for a longer period, but not all bonds have been raised at lower interest rates. Short-term loans typically have lower interest rates. However, some loans’ interest rates are extremely high. The government officials will have to maintain the fiscal balance.”

As per the data on SGS, some loans have been obtained at 9% interest. “Since interest rates have risen recently, 7% interest is fine. Anything above 8% interest rate is not better negotiated,” he said. Telangana raised Rs 37,109 crore as borrowings in 2019-20, which increased to Rs 45,716 crore in 2021-22. When compared to other states, the bonds raised by Telangana have not increased significantly, officials said.

Source link